If your clients make products, you may need to help them with cost accounting, and there are a few different types of numbers you should track. Depending on the situation, you may want to use all of these costs in different ways. Here’s a closer look at how these concepts work and a few tips on how to utilize them.

Do you own a business?

If costs are not effectively controlled, frequent cost over runs may occur which would adversely affect the profitability as well as the commercial viability of the enterprise. Cost control involves several steps including planning, communicating of plans, variance analysis and ultimately decision making to manage reported variances. Budgetary control is a process used by organizations to plan and manage their financial resources in order to achieve specific goals and objectives.

Content: Standard Costing Vs Budgetary Control

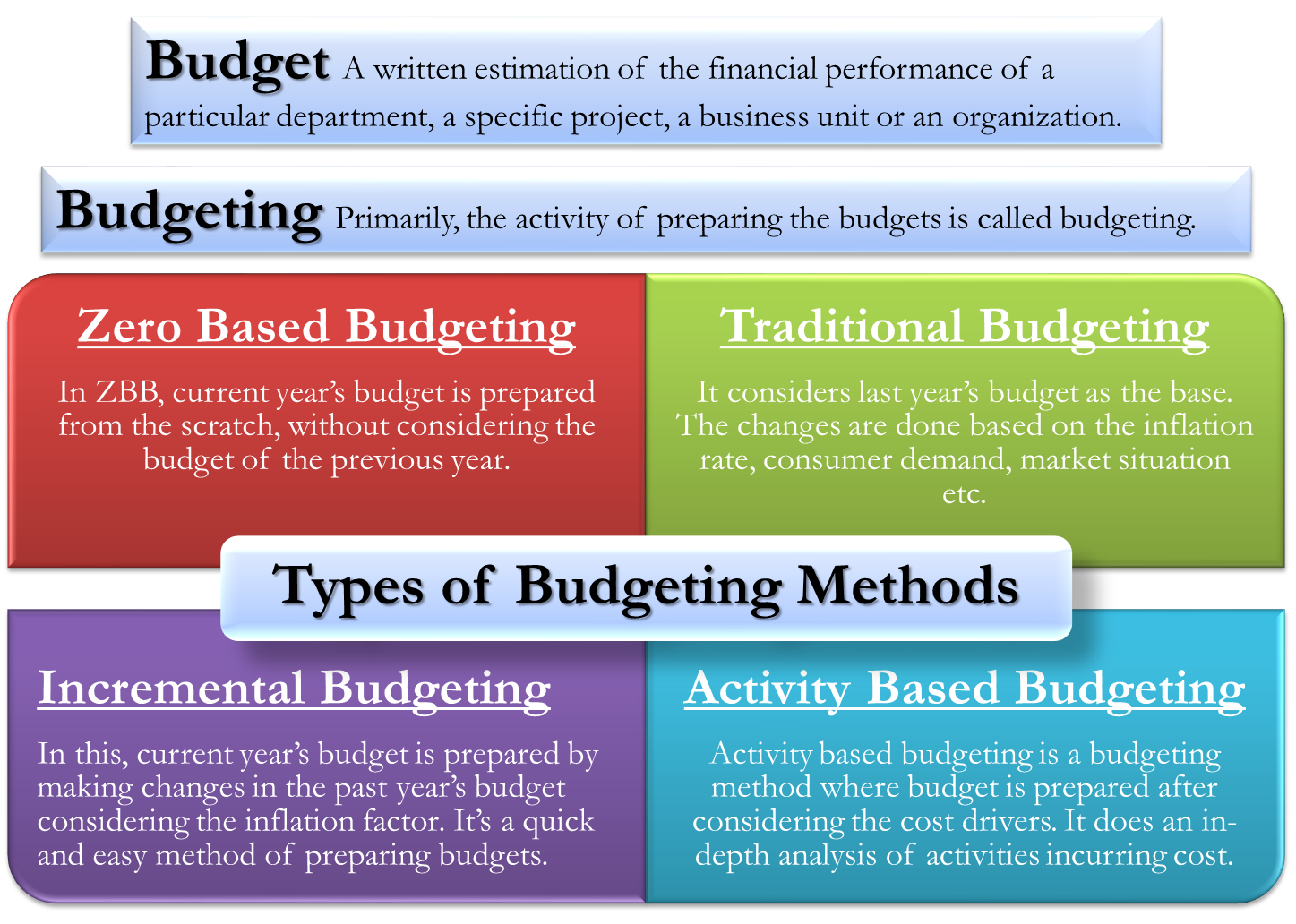

A standard is prepared by a few operation personnel who decide on a benchmark for the organization. A standard state the minimum and maximum limits of production and does not clearly state how to reach the ultimate and not get to the minimum. If you are confused about the clear-cut difference between a budget and a standard, the following paragraphs explain five significant differences you should consider. Like the literal meaning of a standard, the business meaning of a standard suggests that there is an entity that needs to be controlled for effectiveness. Budgets are essential to the survival and effective management of every sector that uses money, such as the individual, family, organizations, and government. A budget is simply a well-thought-out financial plan for a given period, often a year.

Terms Similar to Standard Budget

In the context of cost and management accounting, a standard is essentially the pre-established quantity or cost of input(s) required to manufacture a unit of a product or to provide a particular service. Standards are used as the basis of comparison with actual costs or volumes in variance analysis. There are two types of variances i.e. favorable (actual cost is less than the standard cost) and adverse (actual costs exceed standard costs). The objective of preparation of a budget is to forecast the likely revenue streams and expense outflows for a specific time period and to implement budgetary control.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Management attention is then drawn to any unfavorable variances for investigating into the causes and taking the corrective actions to control costs. The linkage of bonuses to the budget also means that employees are more likely to pad their budgets to make them easier to achieve. Padding means that quantity in math definition uses and examples video and lesson transcript revenue targets are set artificially low, while expense targets are set too high. Crises ranging from natural disasters to broken machinery can all lead to variances between standard and actual costs. Assume that total number of expected machine hours is 40,000 to finish the 50,000 units of product.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- This is also used to mean the desired cost that will be used up in the manufacture of a product.

- In conclusion, standard costing and budgetary control are two distinct yet interconnected techniques used in cost management and financial planning within organizations.

- Both Standard Costing and Budgetary Control are the techniques which provide a yardstick to judge the performance and analyze disagreement of the actual and estimated figures.

This article discusses the difference between a budget and a standard in the most understandable form. Budgeting isn’t going to bring you magic money, but it can help you manage financial decisions and prepare for challenges. A budget helps you limit your spending and allows you to earmark money for an emergency fund. Budgets and standards are comprehensive but vary slightly in their level of comprehensiveness. Using a budget in place of a standard; amounts to ineffectiveness and could lead to mishaps in the accounting year.